My Role

Team

Product Manager - 01

Frontend Developer - 01

Backend Developers - 02

Duration

6 weeks

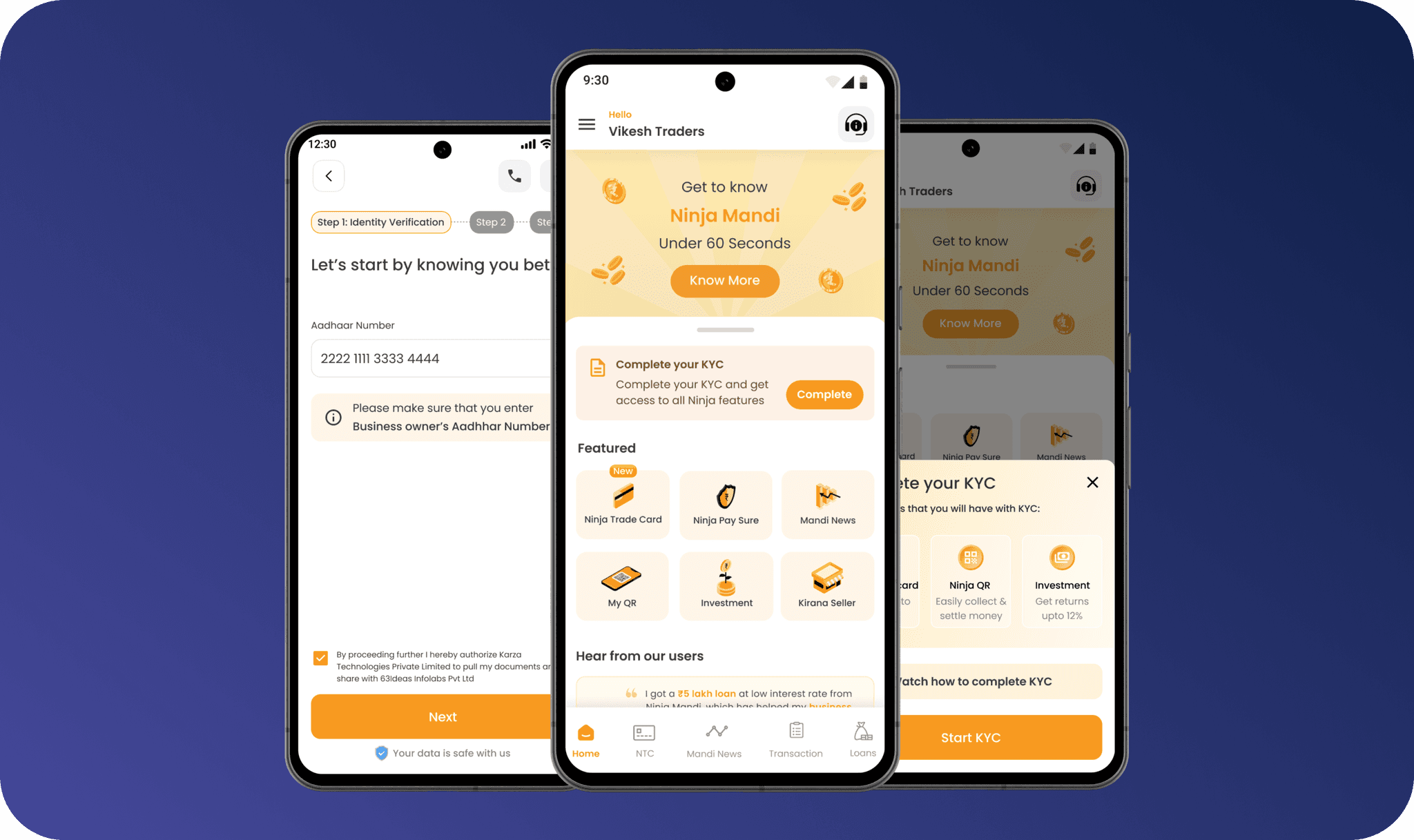

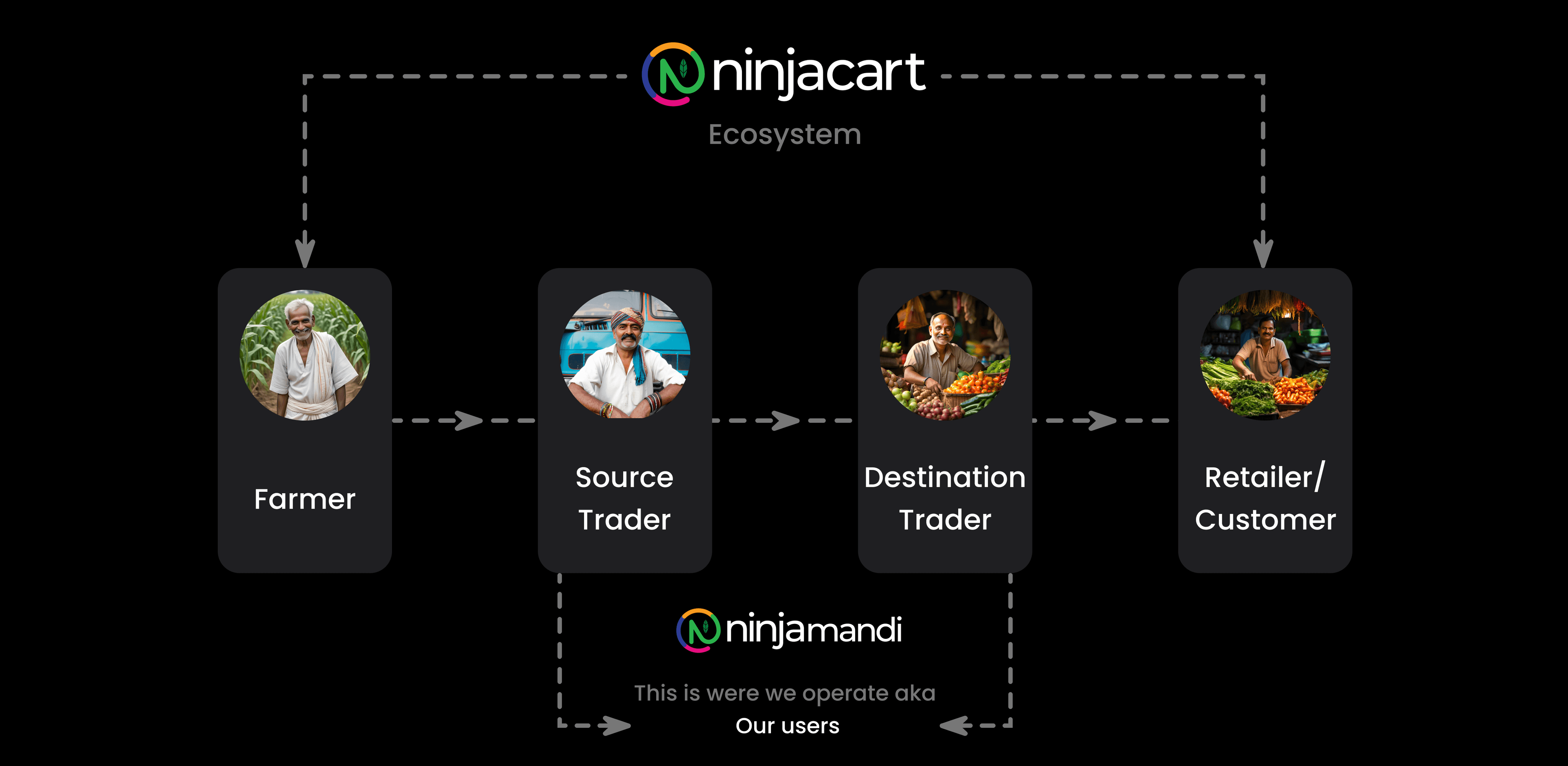

Ninjacart started their journey in financing the agri-traders in Aug. 2021, At that the KYC is process was not automated and it would take around 4-5 days to verify the users. As and when the company started growing and new features coming which requires KYC, a new and new KYC started taking birth in Ninjacart

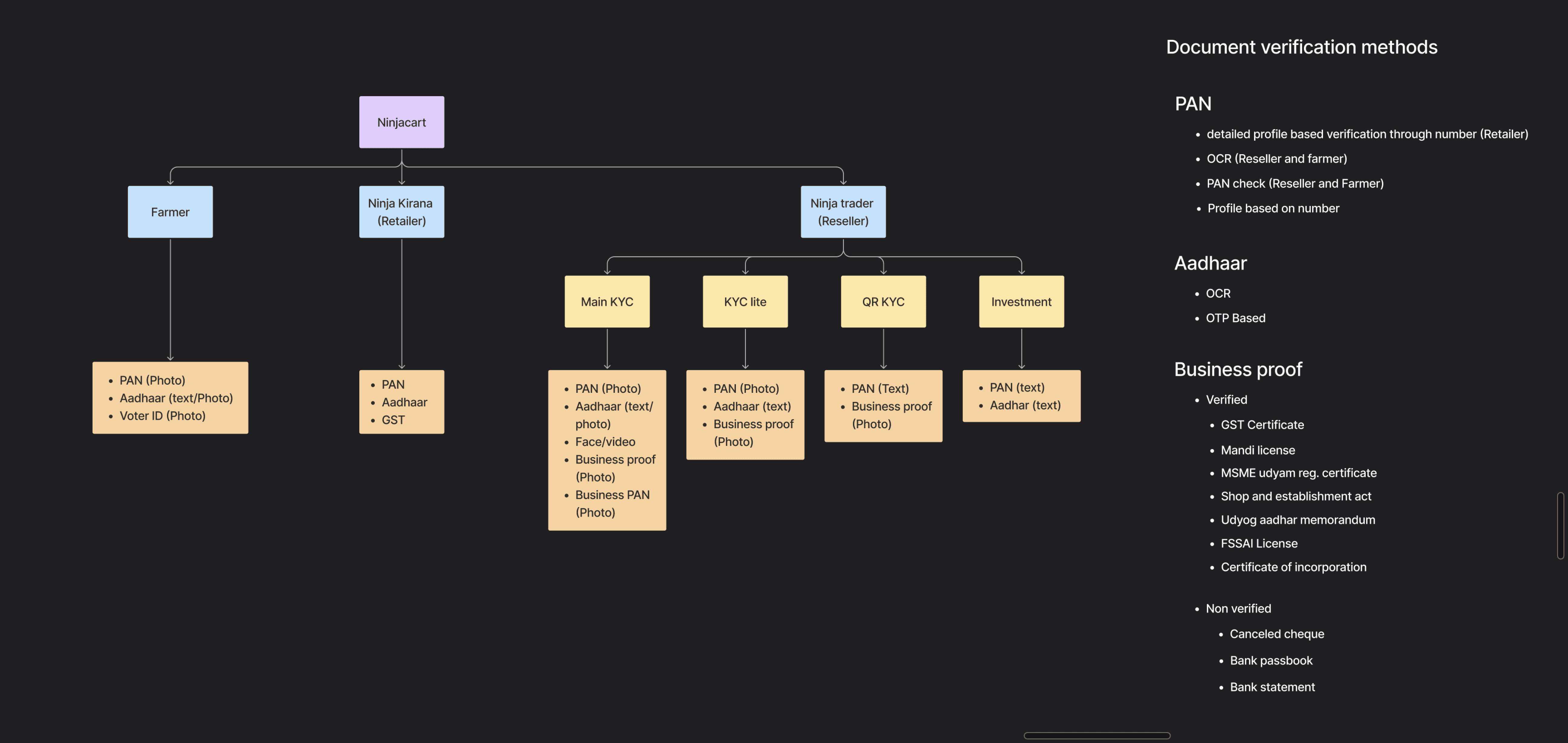

As of today, we had 06 types of KYC which were build as per the requirement of the feature.

KYC is crucial for every financial institution, including Ninjacart. Currently, each pod at Ninjacart has developed its own KYC process, resulting in five different versions.

The manual KYC process would easily take 4-5 business days to verify a user, which means a user is not able to do anything in the app. Users do not receive immediate feedback on errors or status updates, causing delays and confusion and The manual KYC verification process requires significant staff bandwidth, impacting efficiency of the employees

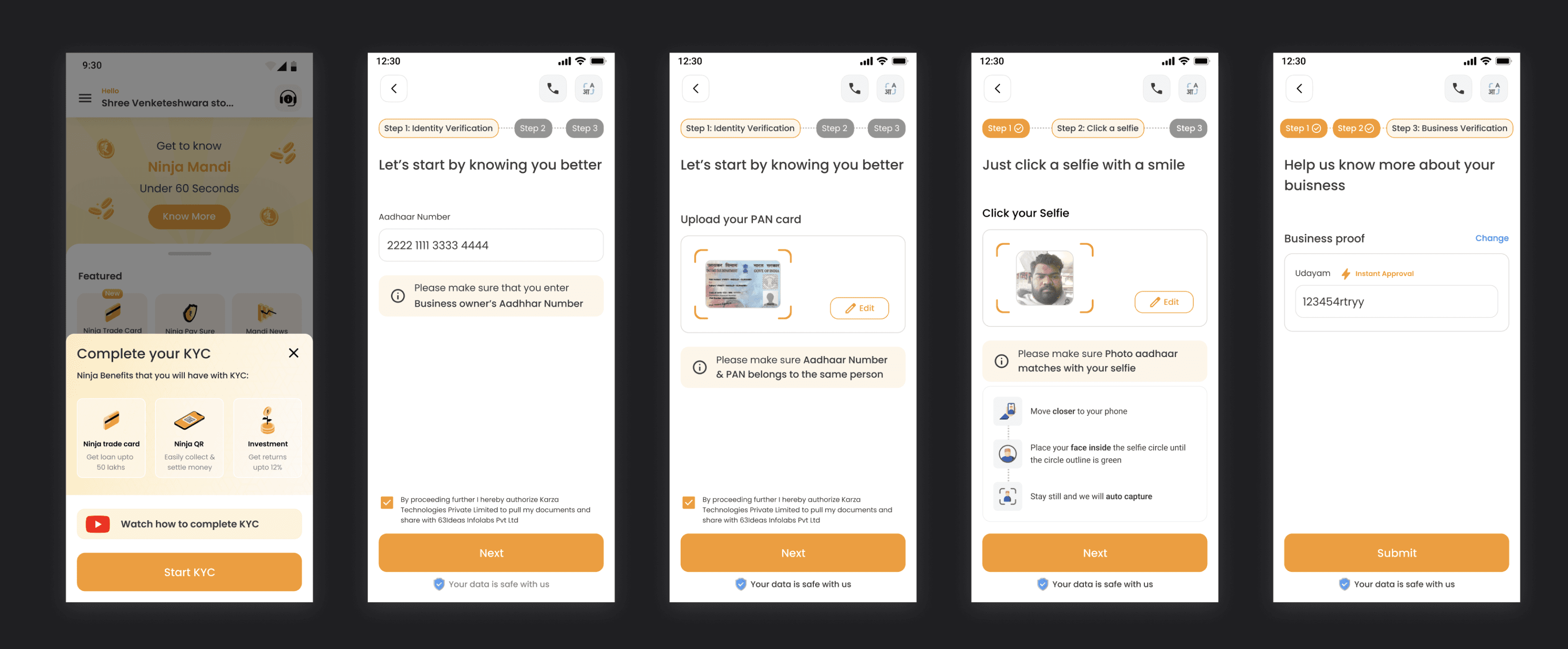

To address this issue, we decided to develop a KYC SDK. This solution will streamline the KYC process, significantly reducing the turnaround time. It will also offer real-time feedback on errors and status updates, enhancing user experience. Additionally, the SDK will be flexible, allowing easy adaptation to Ninjacart's new branding.

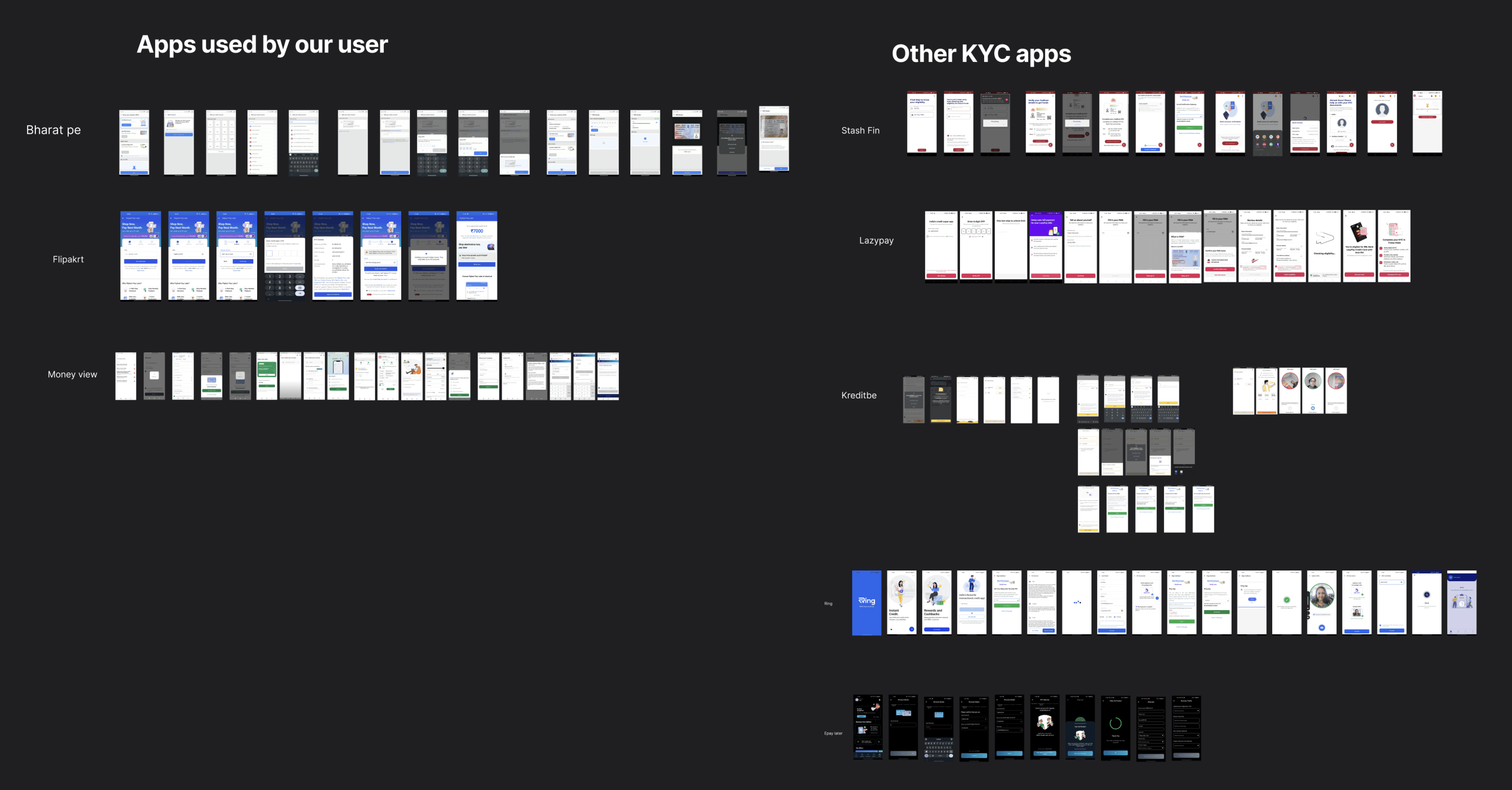

Competitors analysis

At the time of this project, I conducted four user research sessions. Whenever I asked users if they faced any problems in the flow, they always answered: "Everything is good." However, for a particular project (let's call it Project A), there was a requirement that wasn't backed by enough data to make a decision. Despite this, there was pressure from the business team to work on Project A, so I assumed the problem really existed and created two versions to test in the market. It turned out the problem did exist, and one of the versions successfully solved it.

From this experience, it is safe to conclude that directly talking to users may or may not yield useful insights. However, presenting them with something tangible, like a prototype, significantly increases the chances of getting fruitful results. Therefore, I decided to adopt a 'test and reiterate' approach for this project and even in the future.

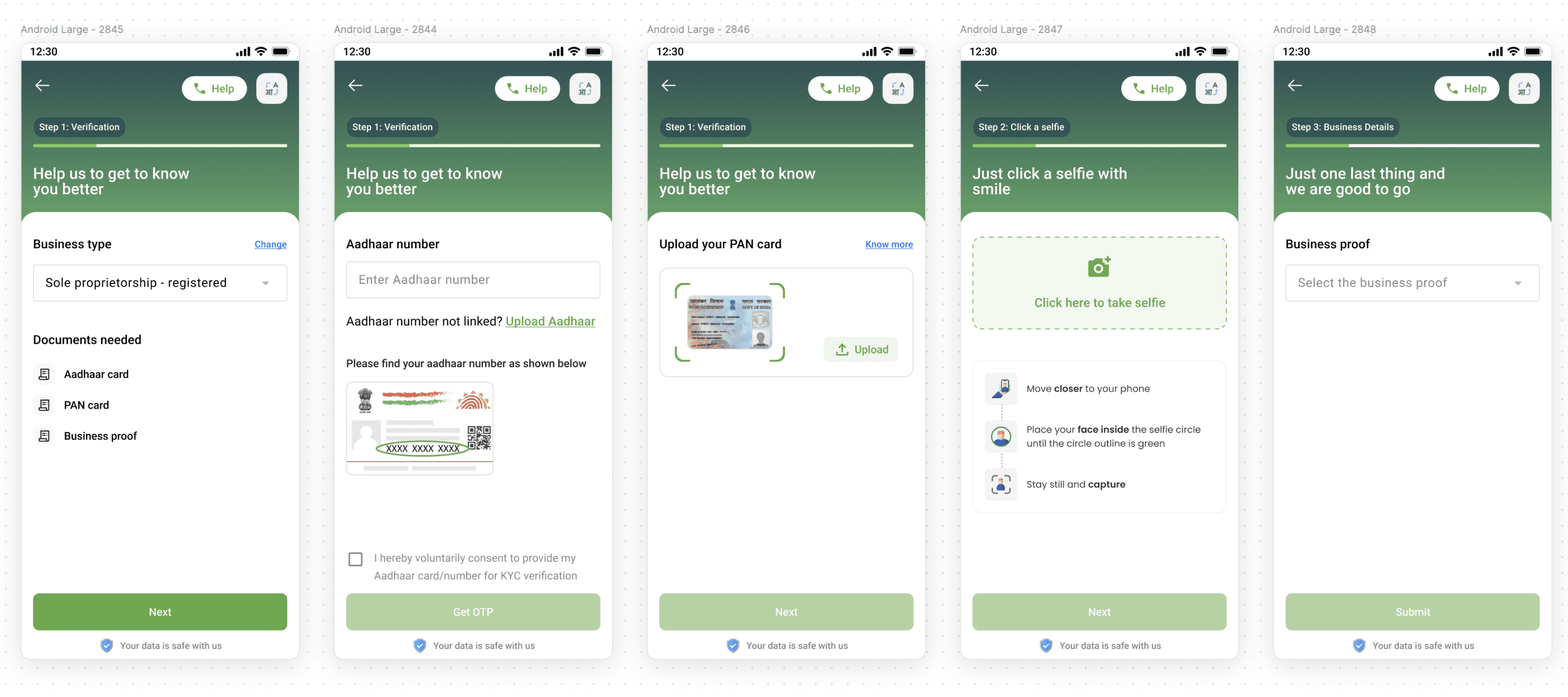

Evolution of KYC

Version 1 of KYC

Location

Chikkballapur market

Participants

07 users

Insights

All users were able to navigate the flow.

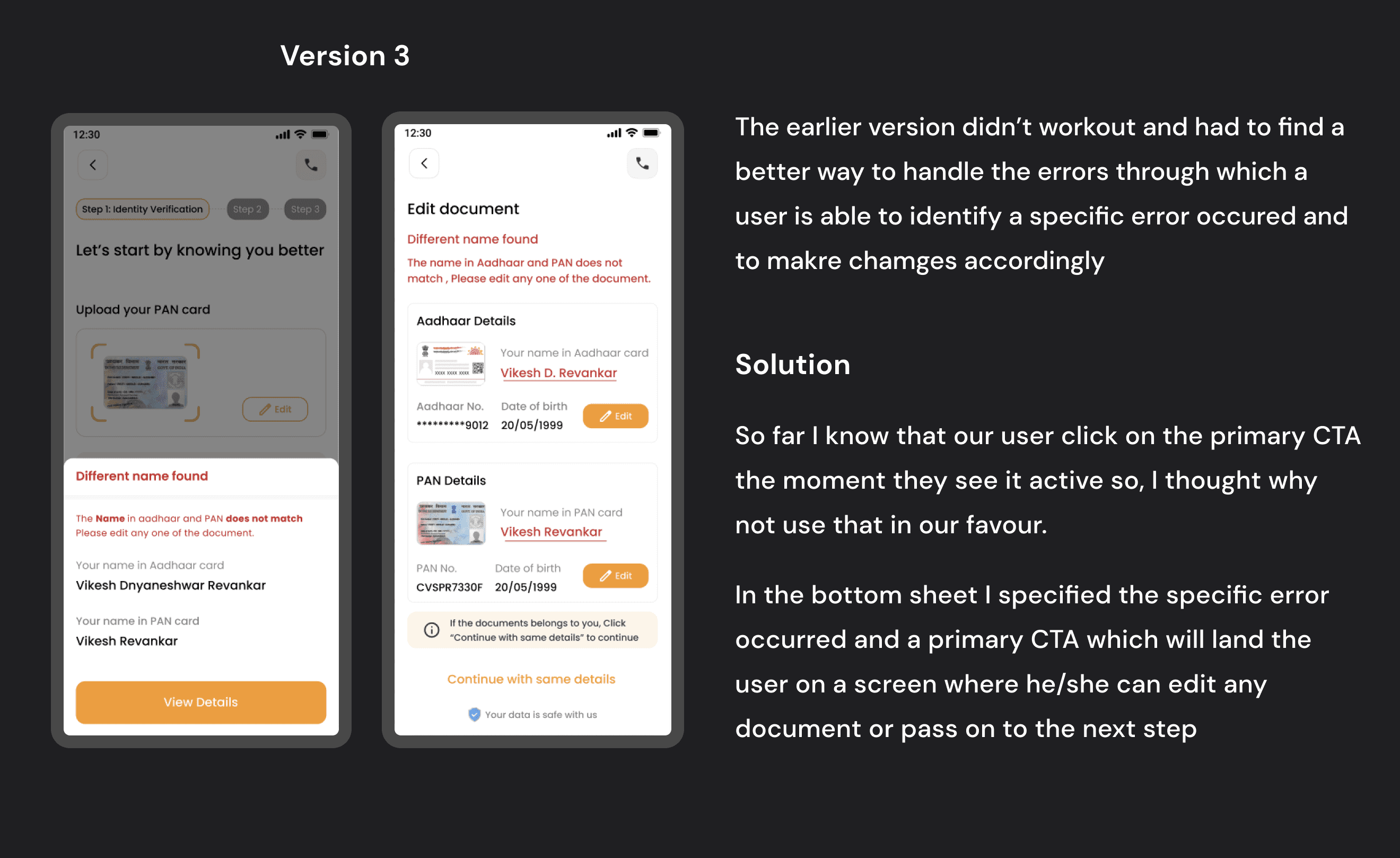

Users tend to click active primary buttons immediately, a behavior that needs validation in other markets.

Challenges

Error - Name Mismatch

INCOME TAX DEPARTMENT

GOVERNMENT. OF INDIA

Permanent Account Number Card

ABCCD1234Z

Name in PAN

Vikesh R

Name in Aadhaar

Vikesh Revankar

Error - Photo Mismatch

Location

Hyderabad market

Participants

11 users

Insights

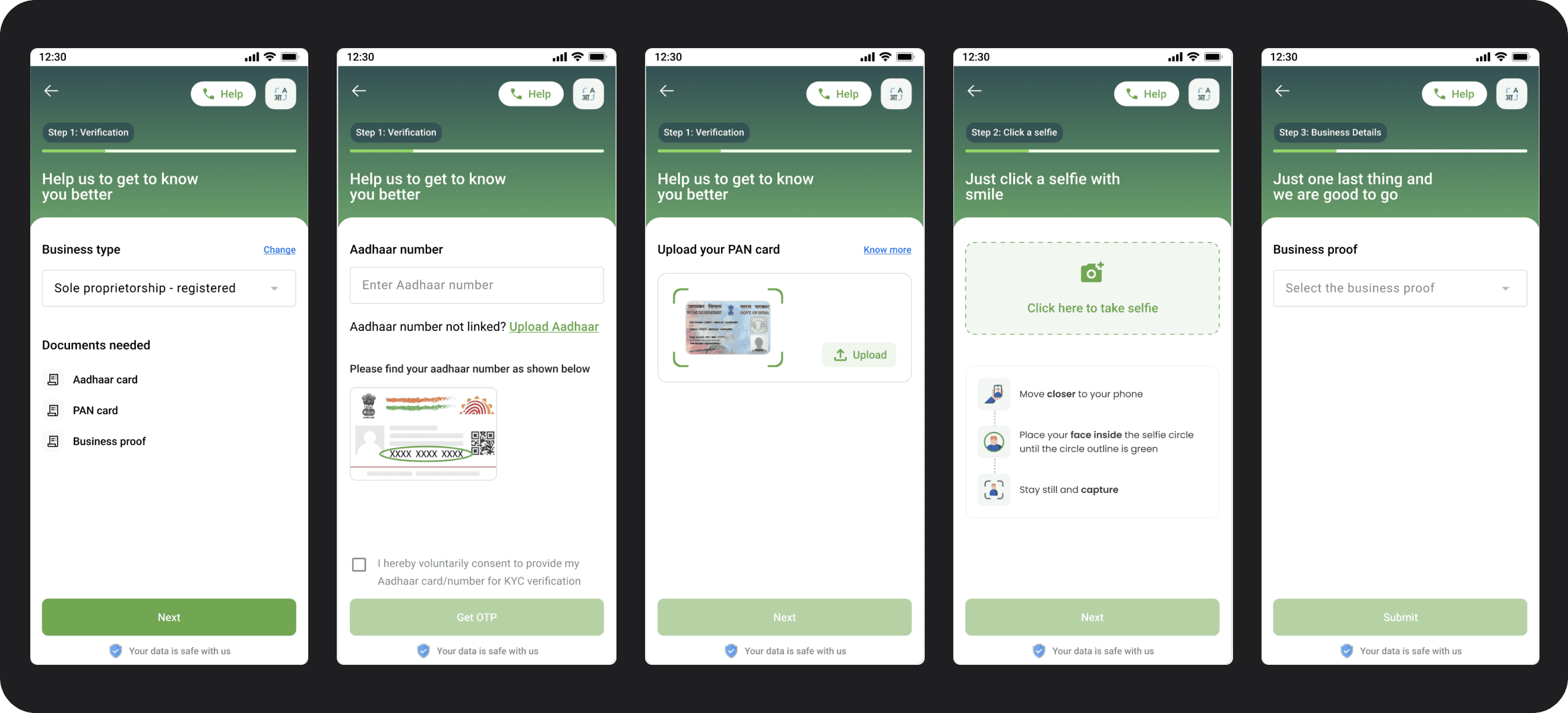

8 out of 11 users navigated the flow without help; 3 needed assistance.

Users tend to click active primary buttons immediately, a behavior that needs validation in other markets.

The hypothesis about users clicking active primary buttons was validated.

Challenges

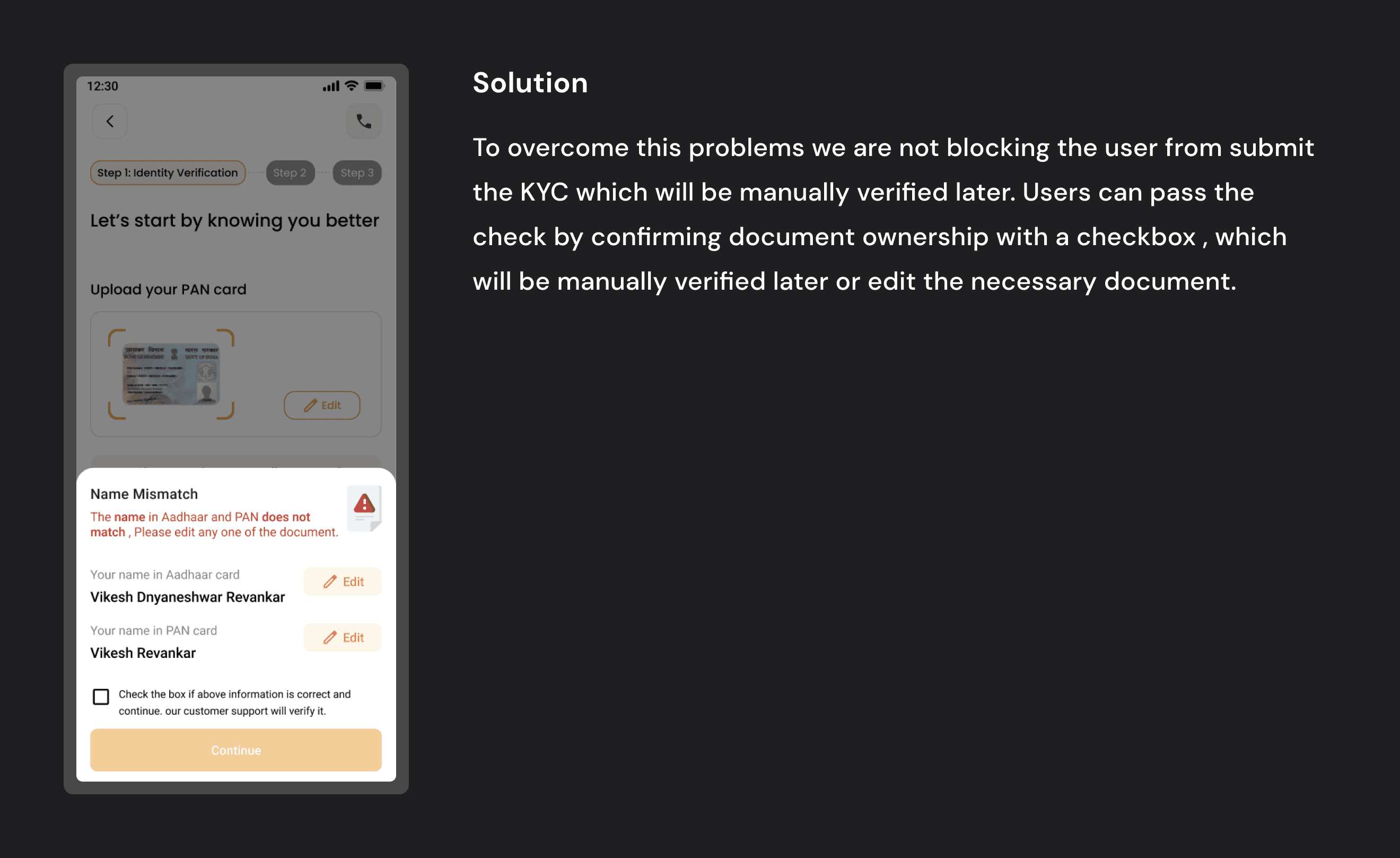

Error handling, particularly with KYC rejections due to name mismatches in documents. For example, if a user's name on their PAN card is "Vikesh R" and on their Aadhaar card it's "Vikesh Revankar," it causes a mismatch. Users can pass the check by confirming document ownership with a checkbox, which will be manually verified later. However, users often ignored the error message and checked the box without reading.

Solution

Location

Huskur market

Participants

06 users

Insights

The hypothesis about users clicking active primary buttons was further validated.

User-Centric Design

Scalability Considerations

Jal lijiye thak gaye honge scroll karke