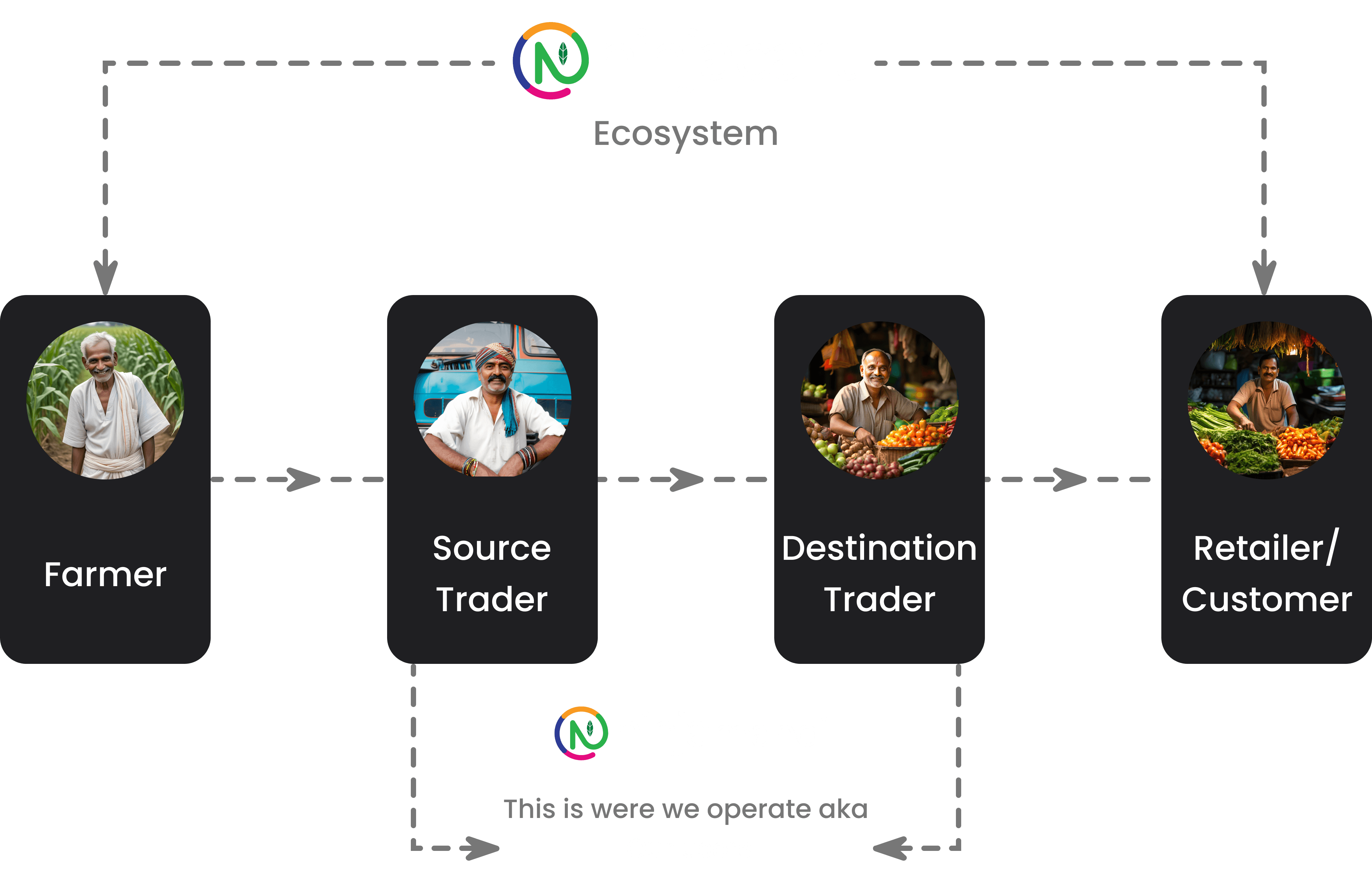

Ninjacart is a leading agri-tech company in India, specialising in transforming the fresh produce supply chain. The company connects farmers directly with retailers, restaurants, and other businesses through an efficient, technology-driven platform. By eliminating intermediaries, NinjaCart ensures fair prices for farmers and fresh, high-quality produce for consumers. Additionally, NinjaCart provides financial support to resellers and retailers, offering them credit.

My Role

Product designer -

Interactions, User Flows, Prototyping, Research and testing

Team

Product Manager - 01

frontend Developer - 02

backend Developer - 01

Duration

3 weeks

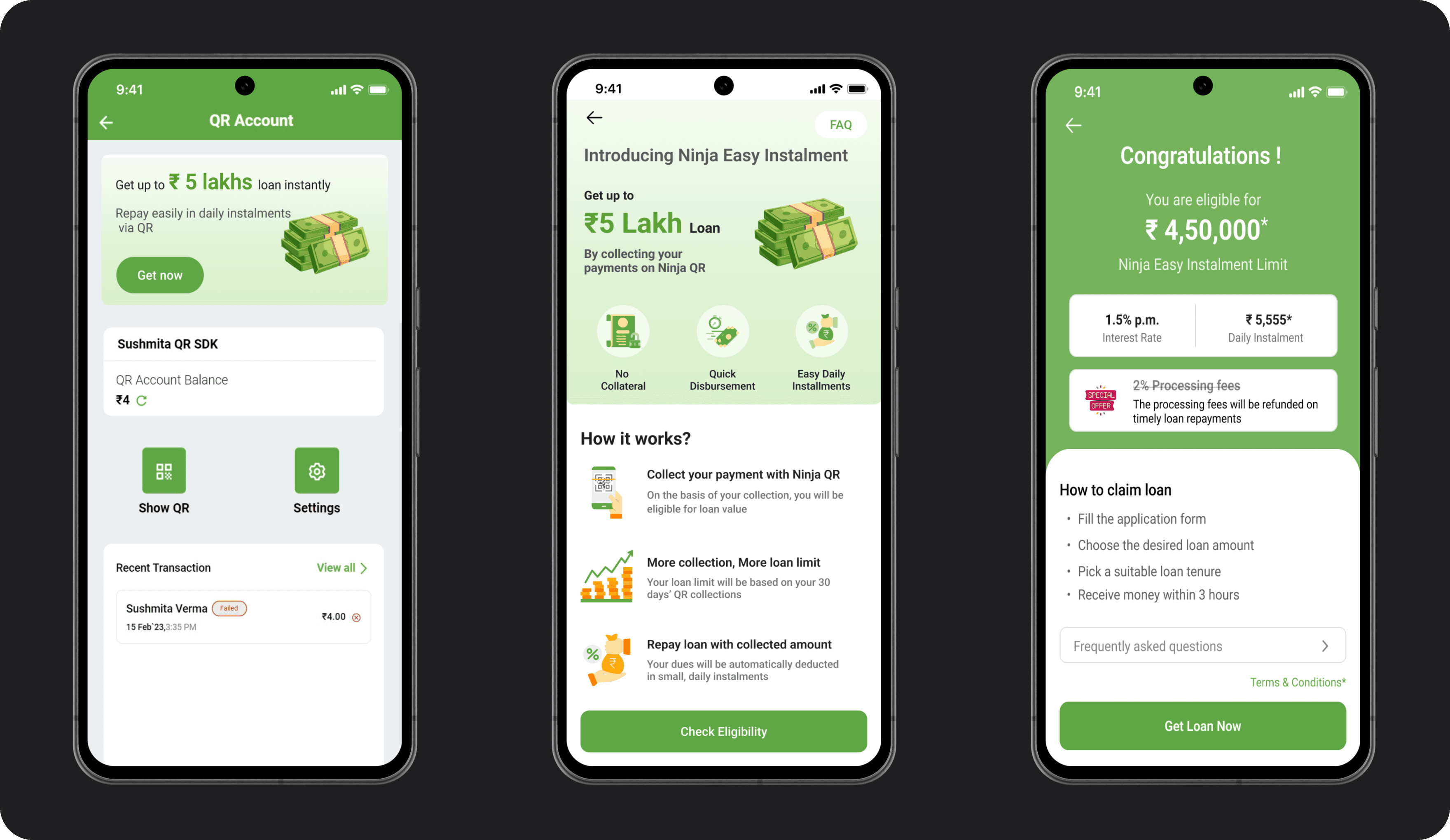

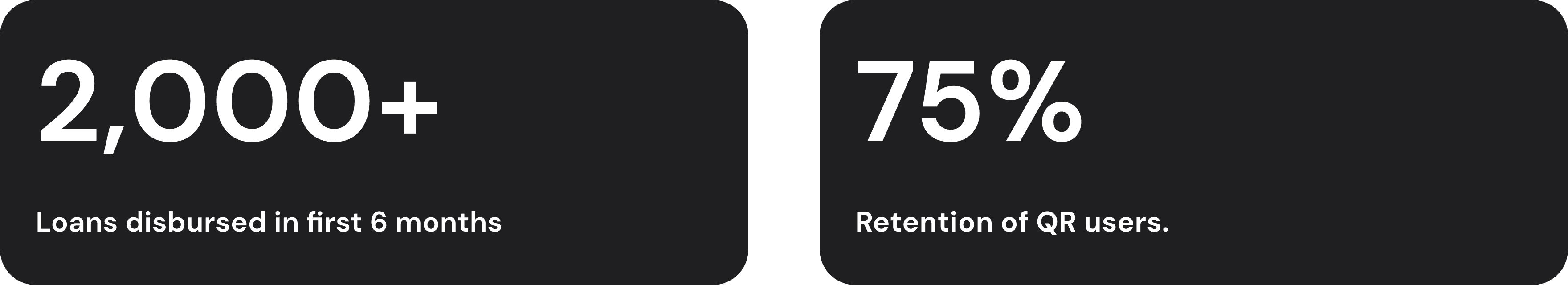

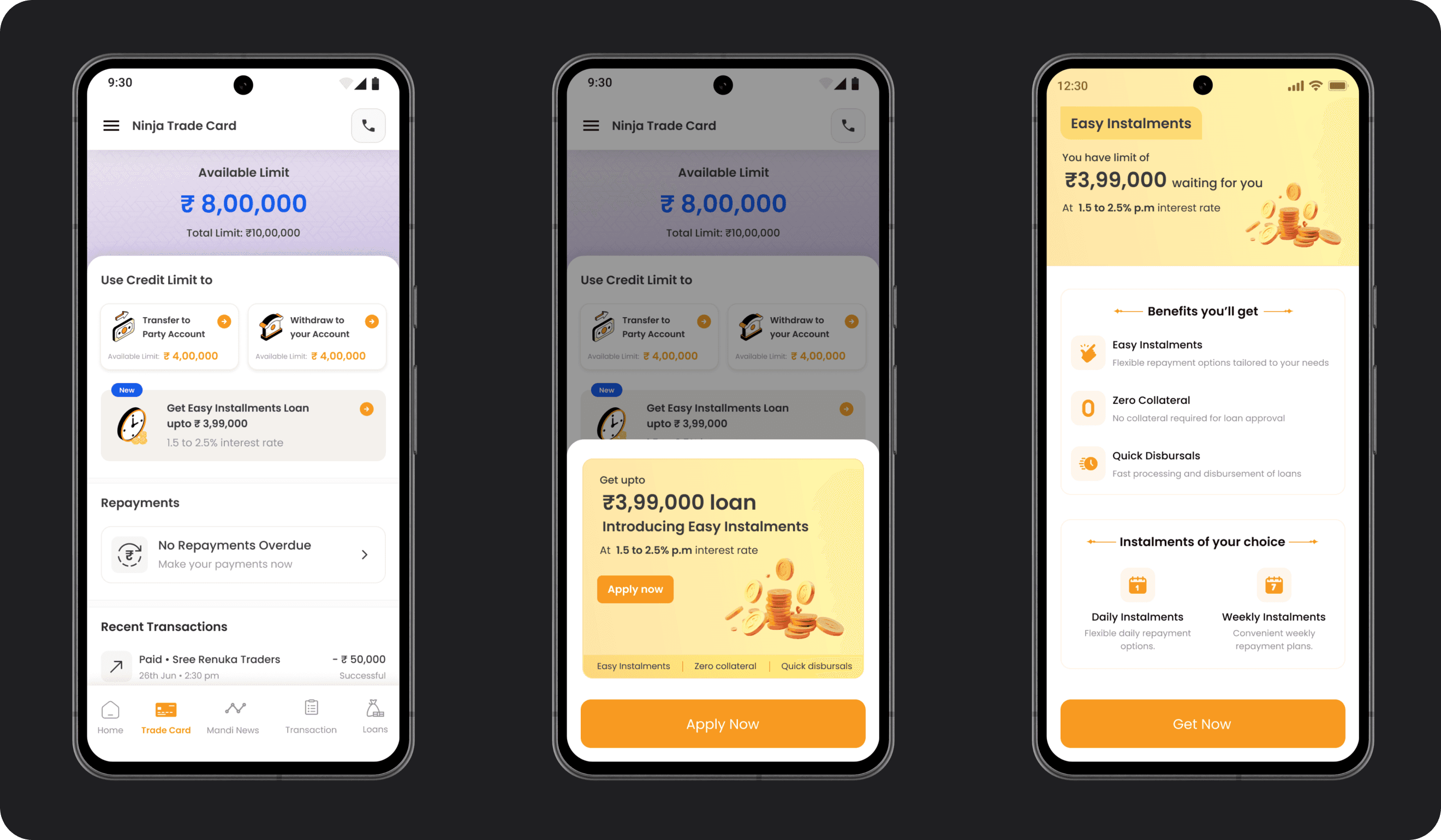

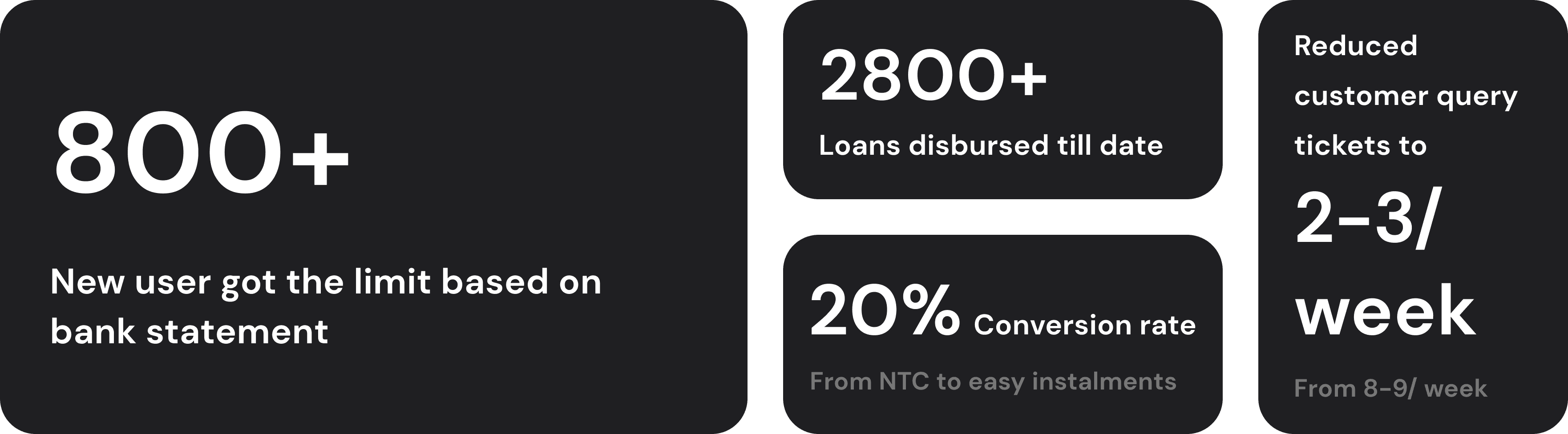

In September 2022, we launched our proprietary QR account, enabling users to collect payments seamlessly. Two months later, we introduced Easy Instalments (often known as EDI), a loan product integrated with the QR account. However, we encountered significant issues with the QR account, leading to a loss of users and impacting the easy instalments business model.

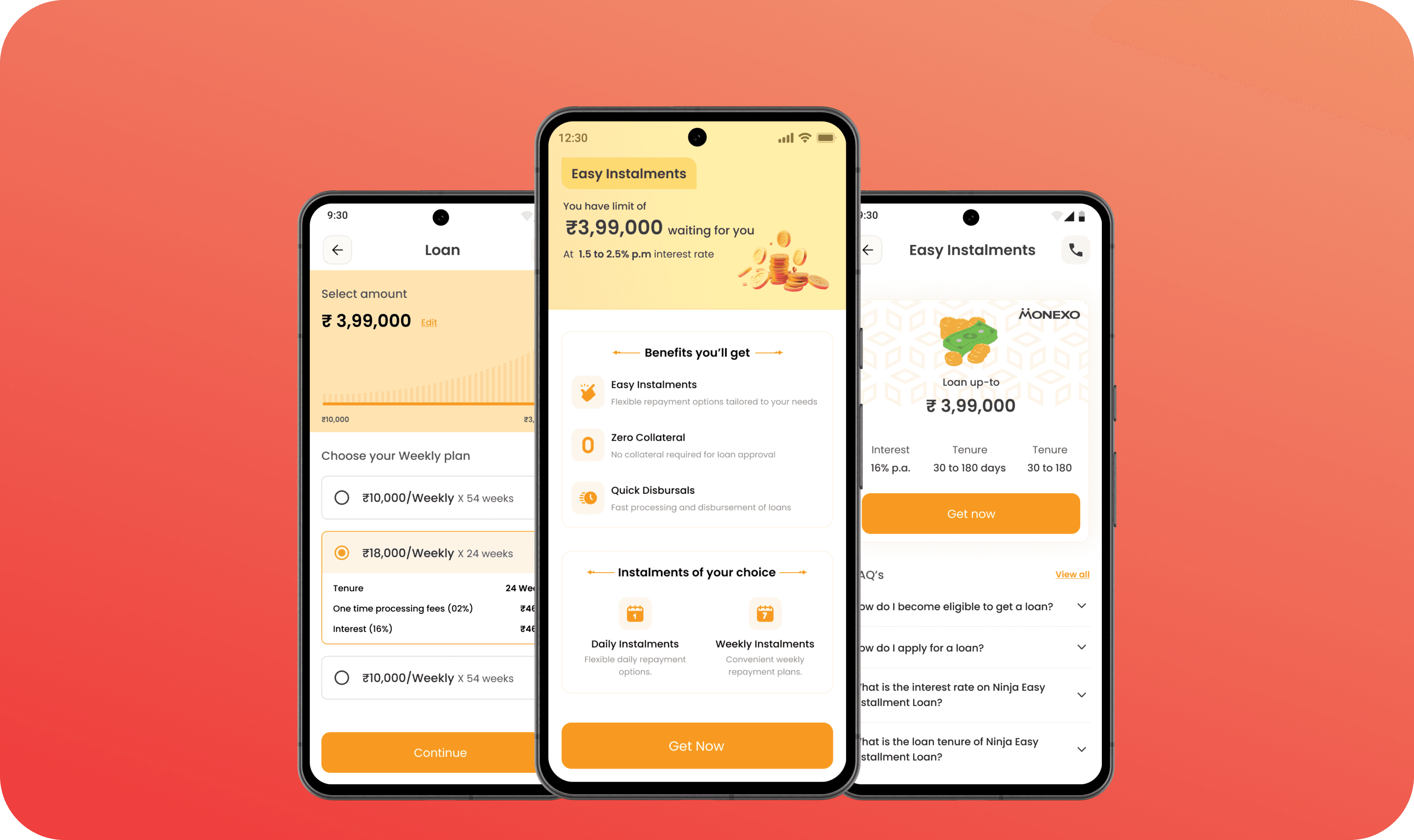

What is Easy Instalments (often known as EDI)?

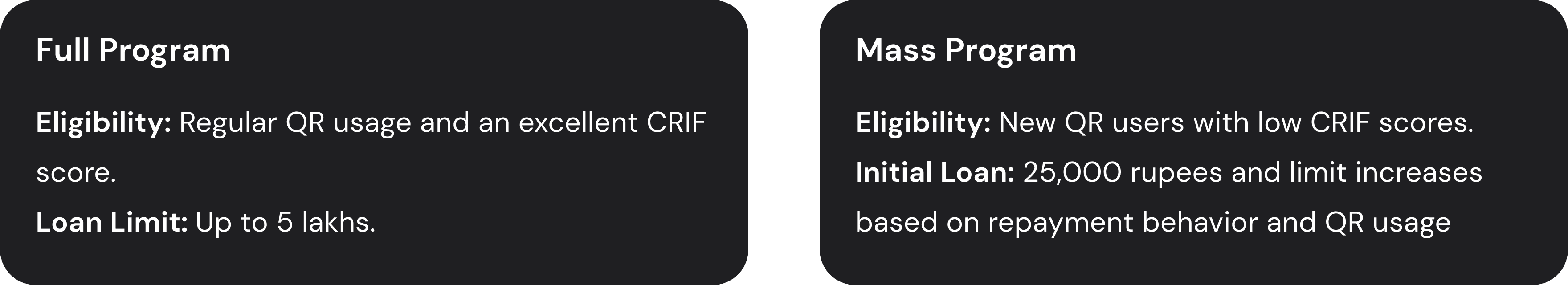

Easy Instalment is a loan product designed based on the amount collected through the QR account. For instance, if a user collects an average of 2000 rupees daily via QR, the rule engine suggests a loan limit ensuring the daily instalment remains under 2000 rupees. Easy Loans features two programs:

Unfortunately we started facing problems with our QR account which led us to shut down the whole QR operations eventually but on the other hand users loved Easy instalments (often known as EDI) and we have to figure out a way easy instalment alive and running.

Given the high demand for easy instalment and the QR account no longer being operational, we needed to find a solution to revive and sustain the easy instalment program.

This was our chance to start from scratch and re-imagine the whole flow. So, we started by research

User Interviews (Primary Research)

Competitors analysis (Secondary Research)

Heuristic elevation (Secondary Research)

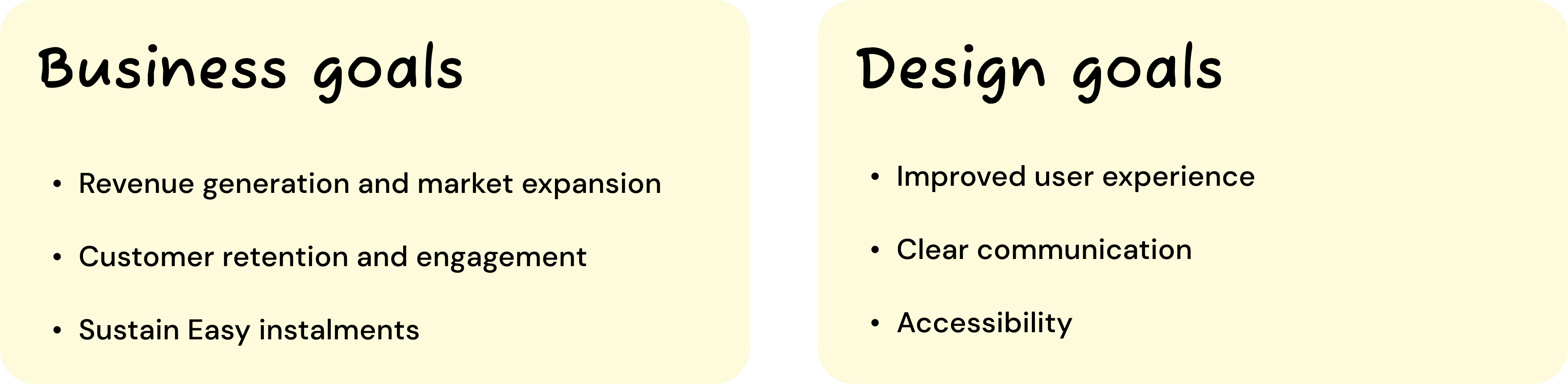

Keep the “Easy instalments” alive

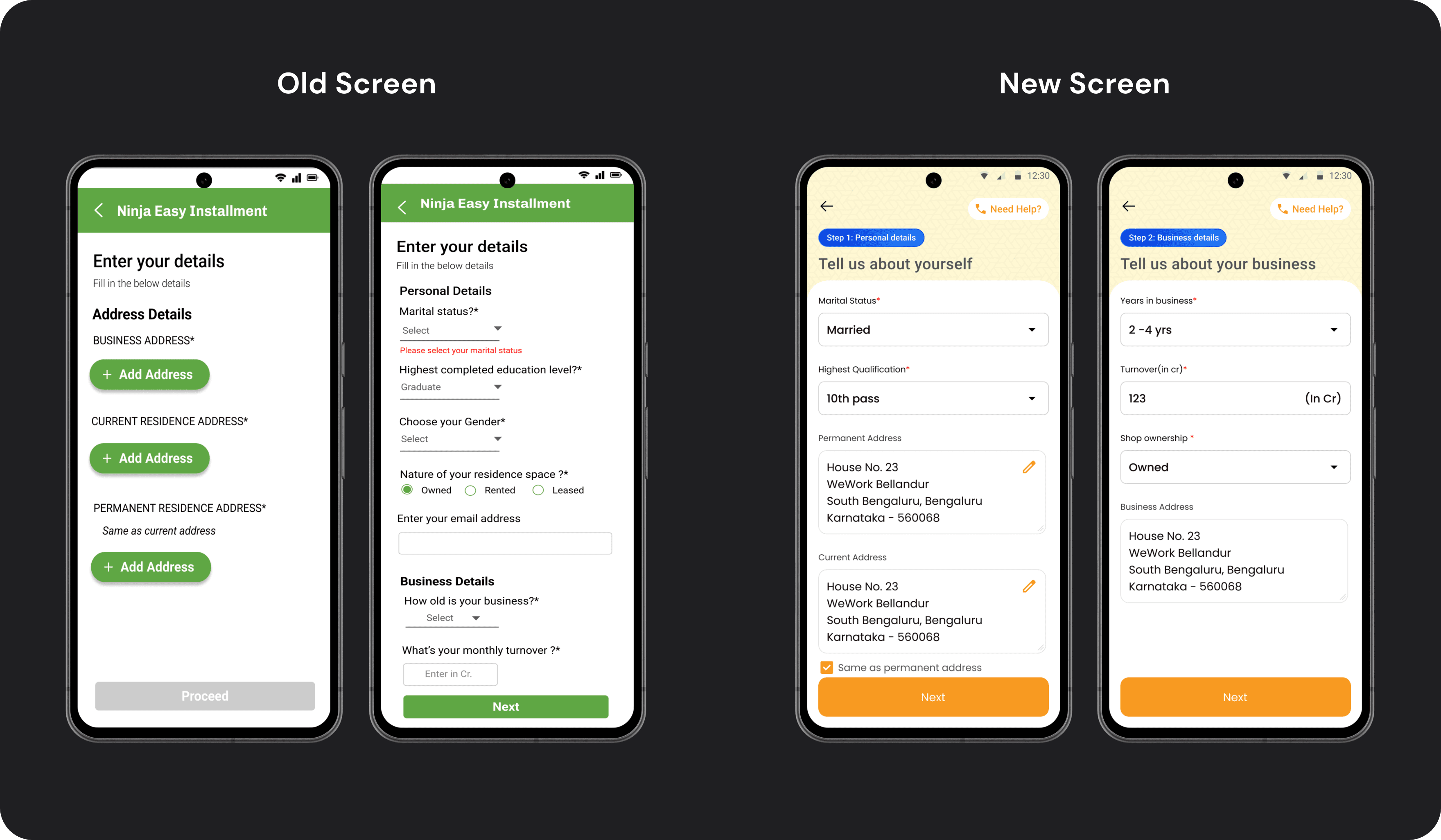

Clean visuals

Transparency & Trust

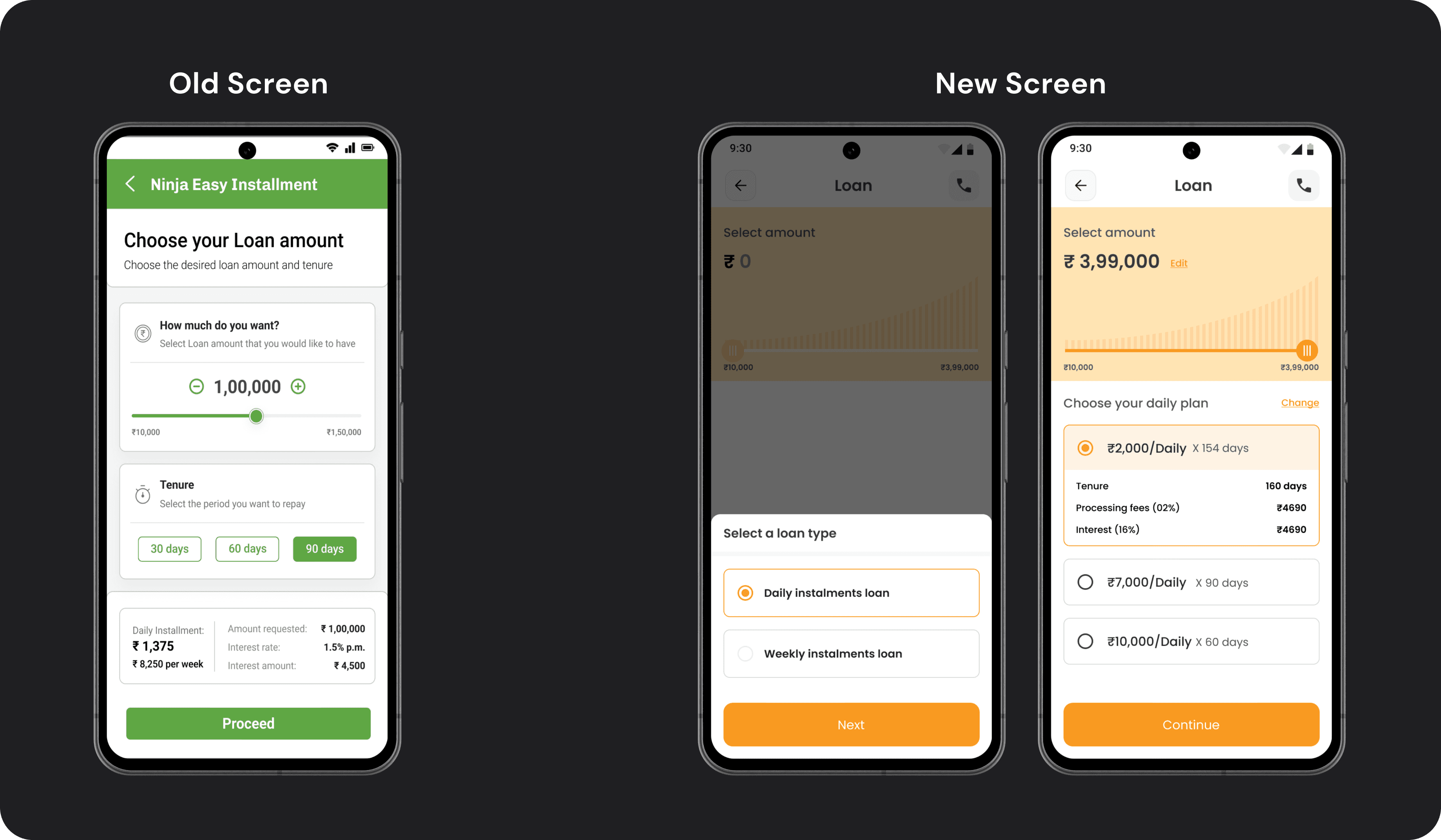

Ease on Daily Instalment amount

Given the high demand for EDI and the QR account no longer being operational, we needed to find a solution to revive and sustain the EDI program.

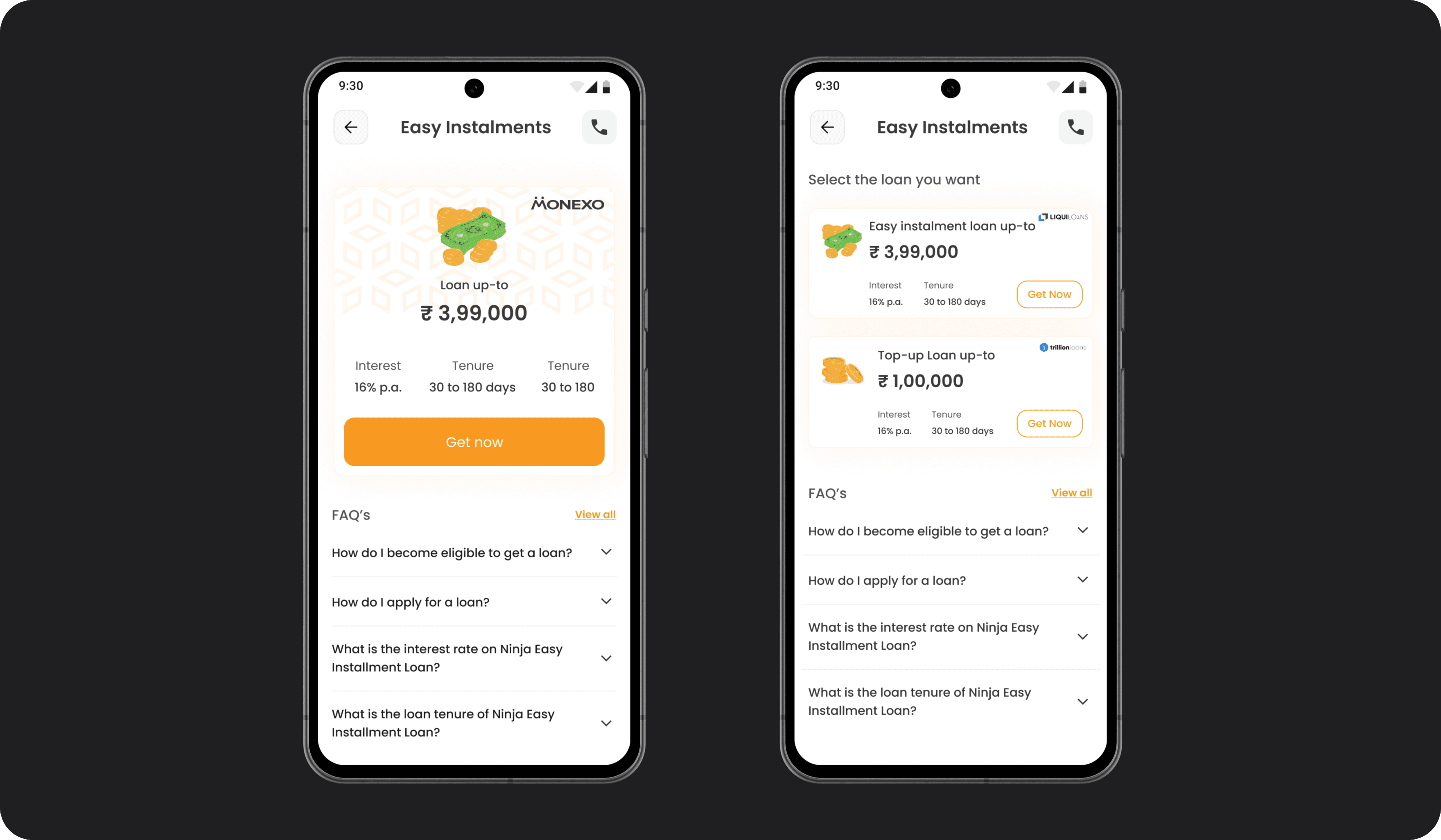

Loan offer

Personal & Business details

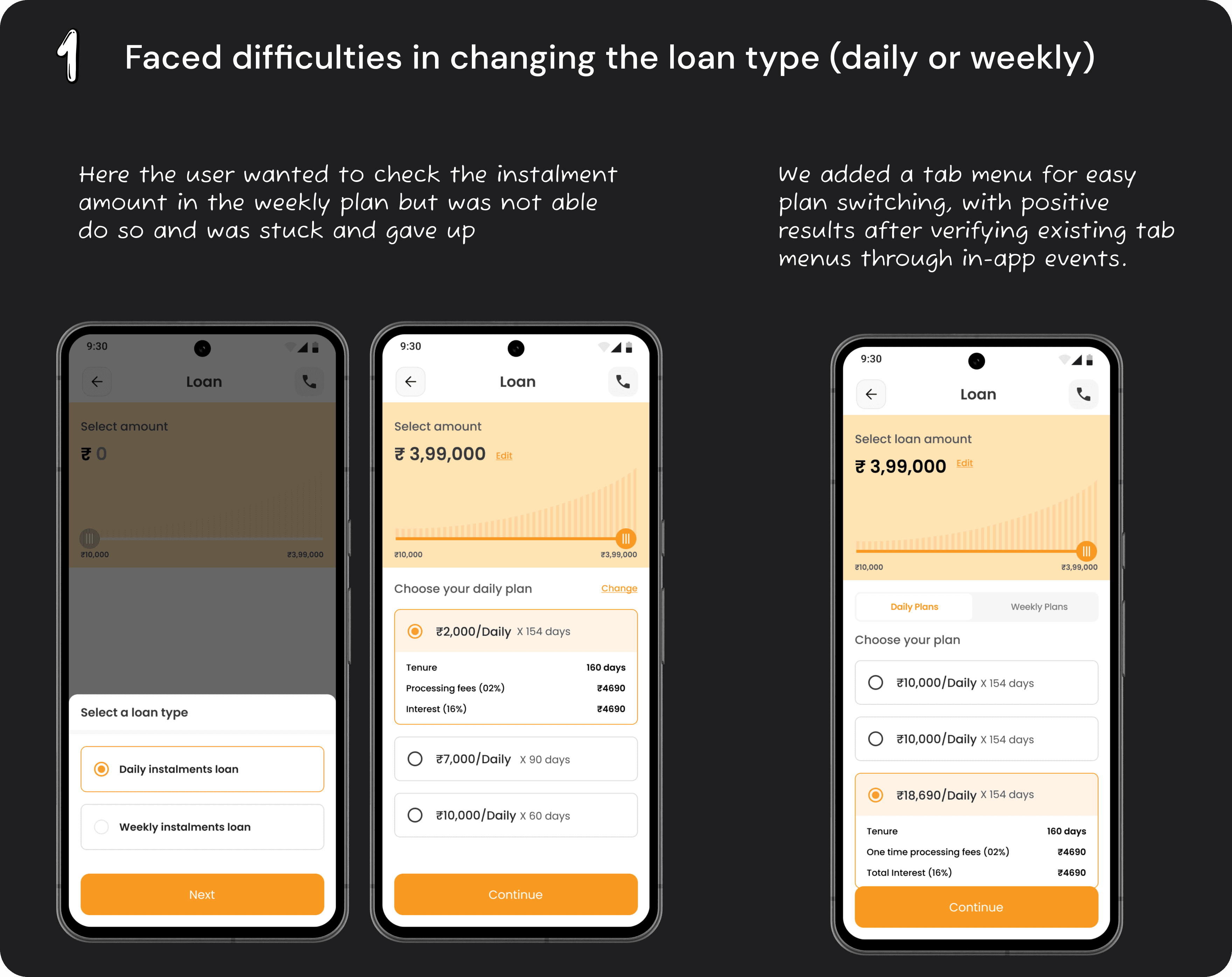

Loan amount and instalment plan selection

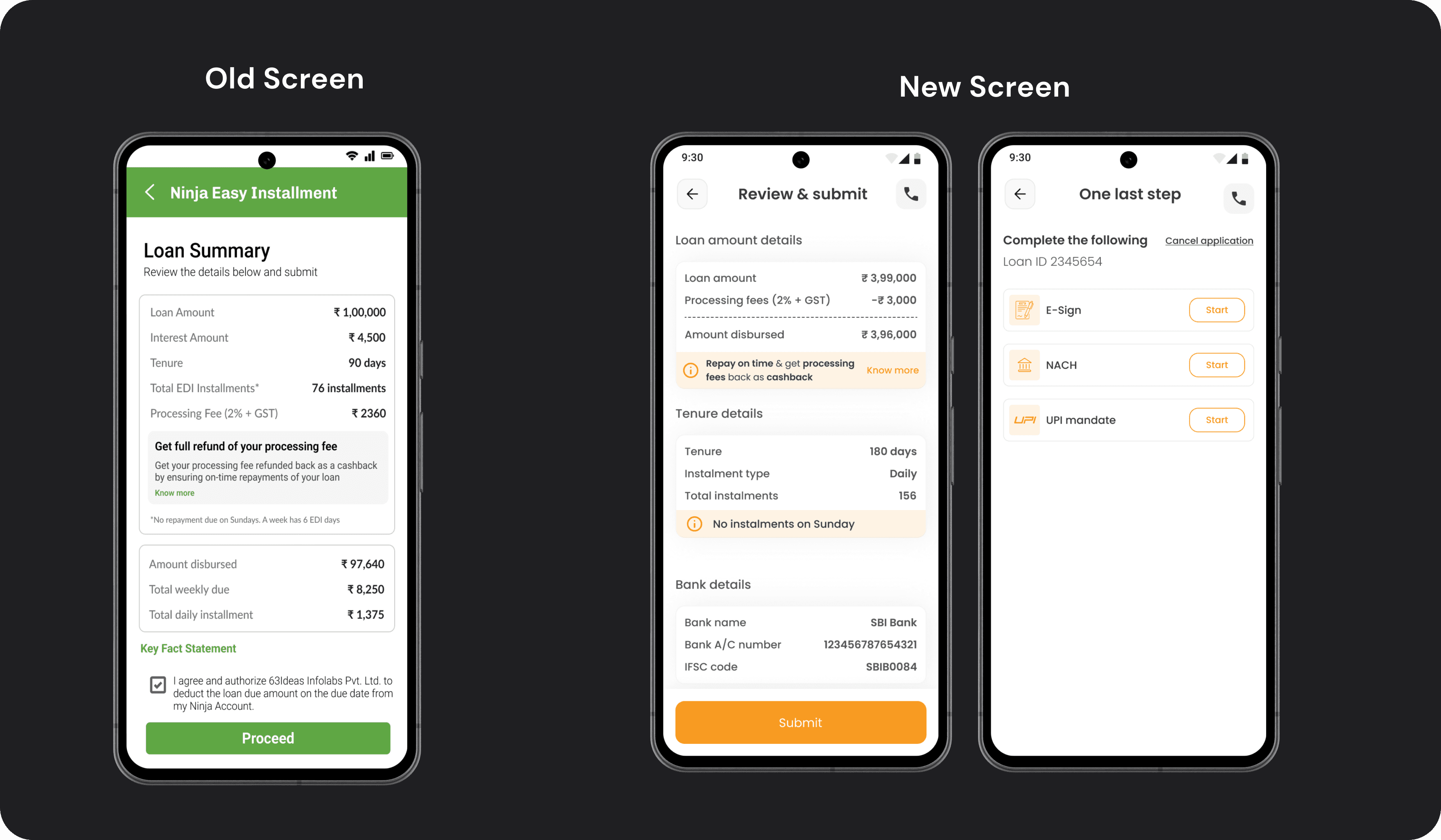

Review and final step

Location

Huskur market

Participants

04 users

Objective

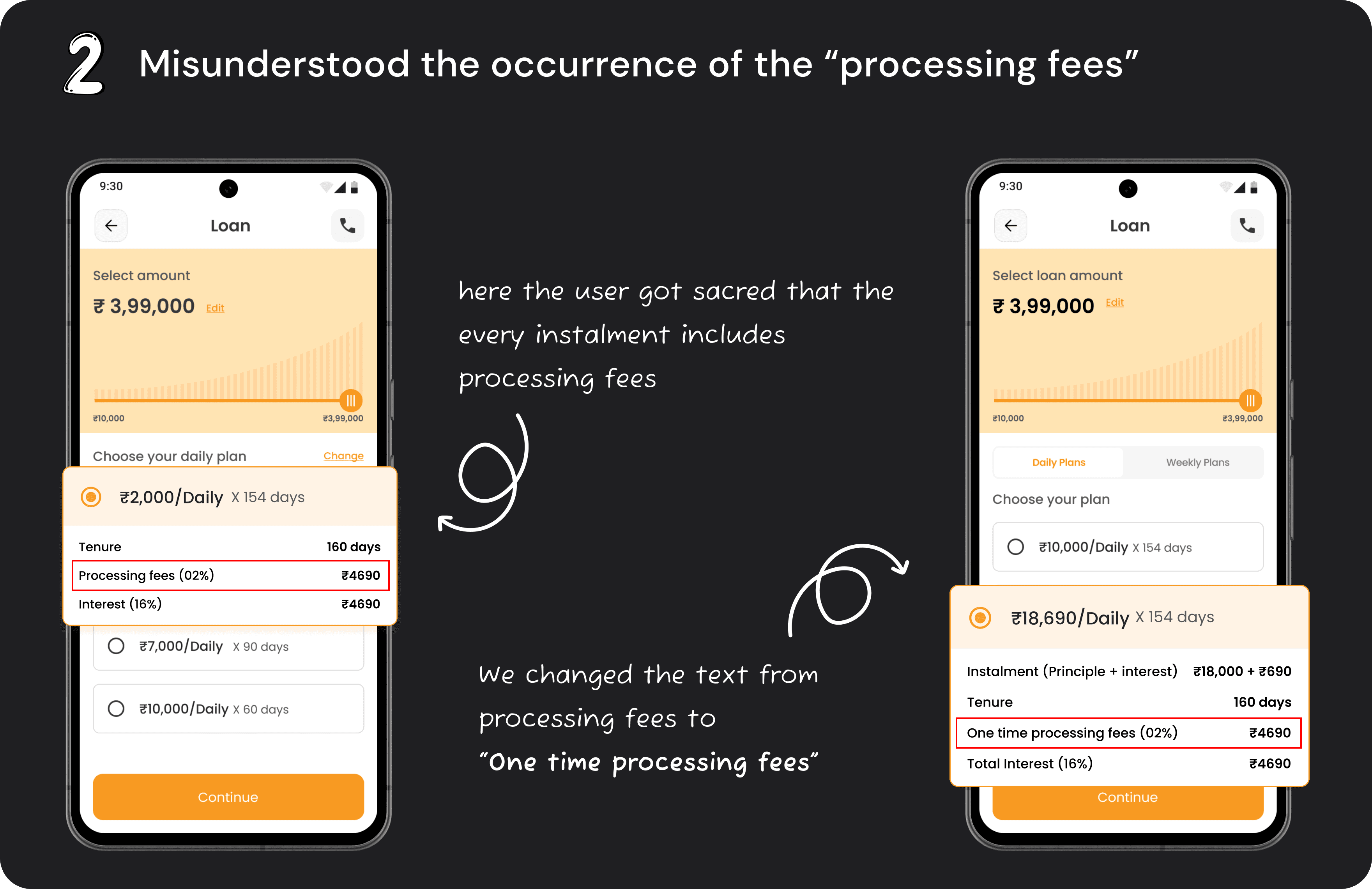

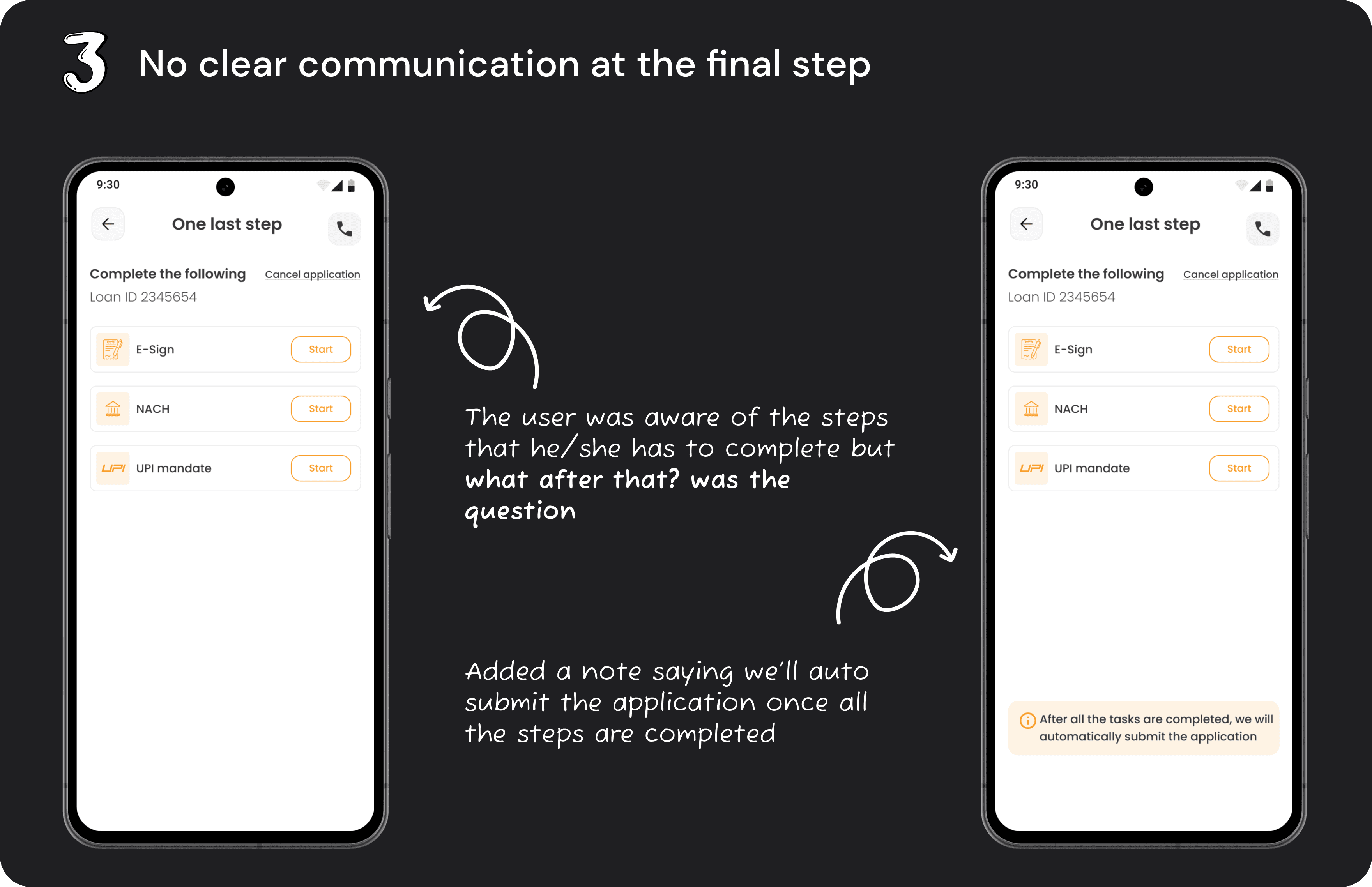

To gather feedback on the overall experience of

Application process

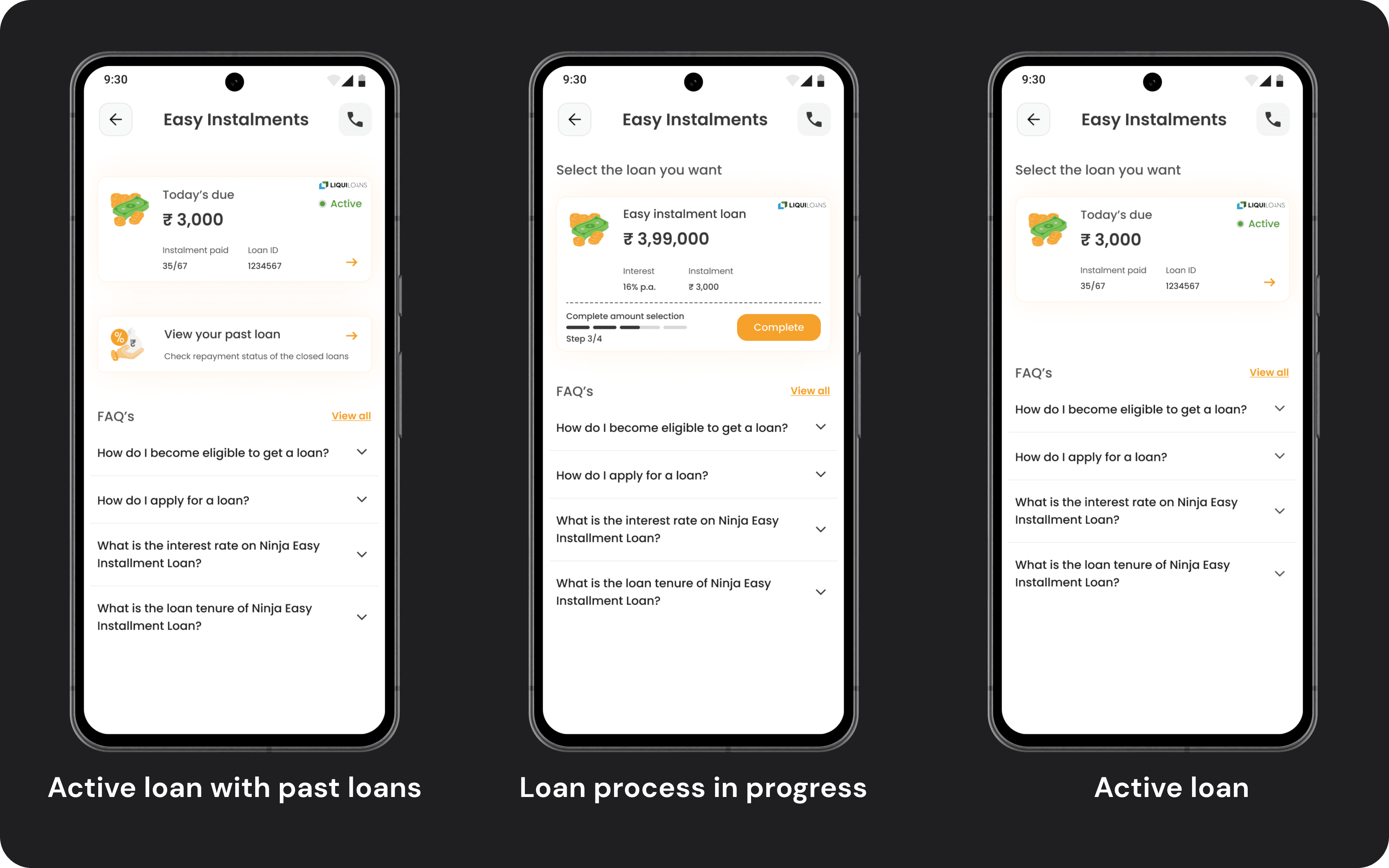

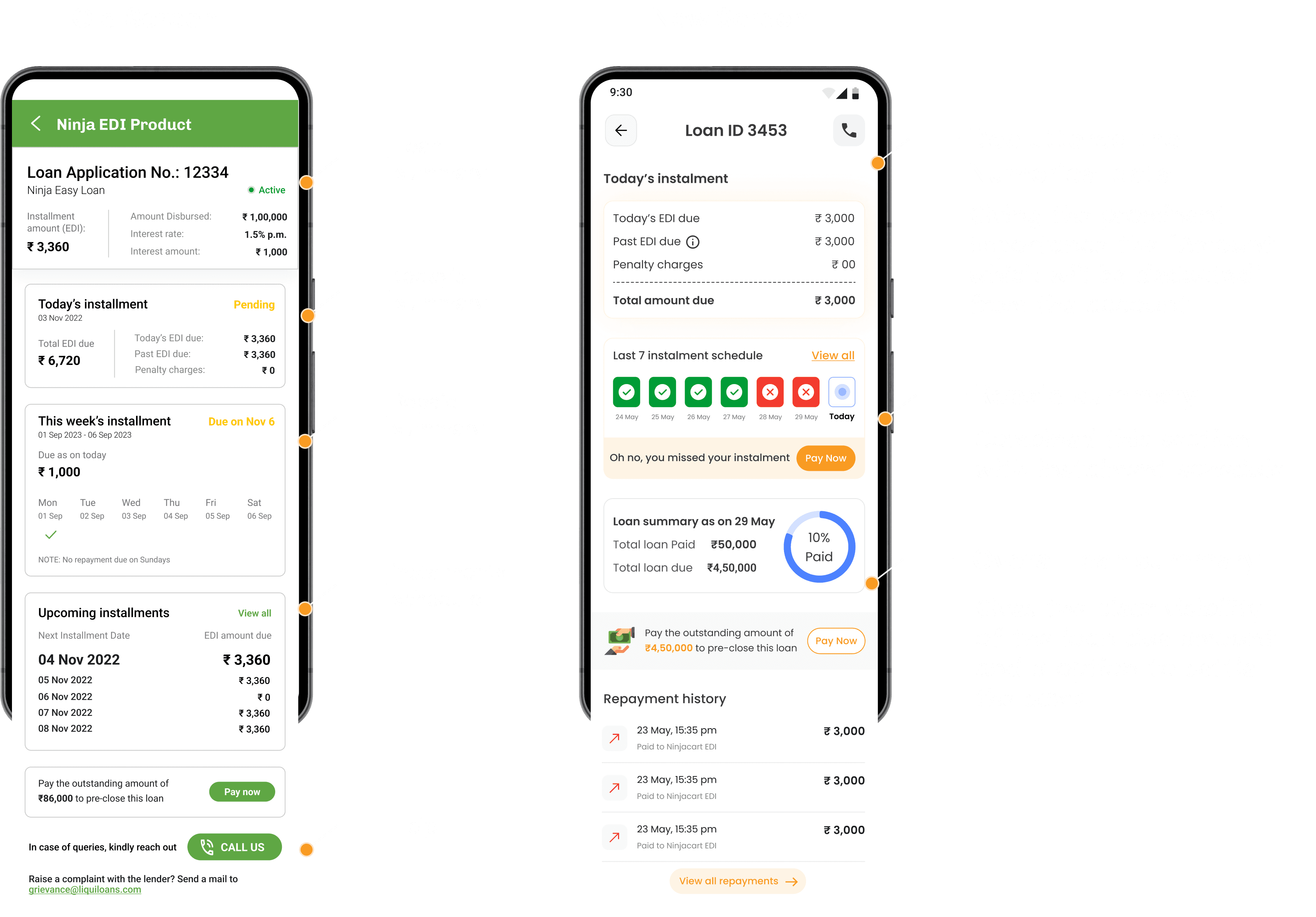

Active loan screen

Repayment flow

User-Centric Design

The importance of involving users in the design and testing phases to create solutions that meet their needs and expectations.

Iterative testing and feedback loops are crucial for refining the product and ensuring it delivers a seamless user experience.